amazon flex take out taxes

They are responsible for paying their taxes at the end the tax year. Knowing your tax write-offs can be a good way to keep that income in your pocket.

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

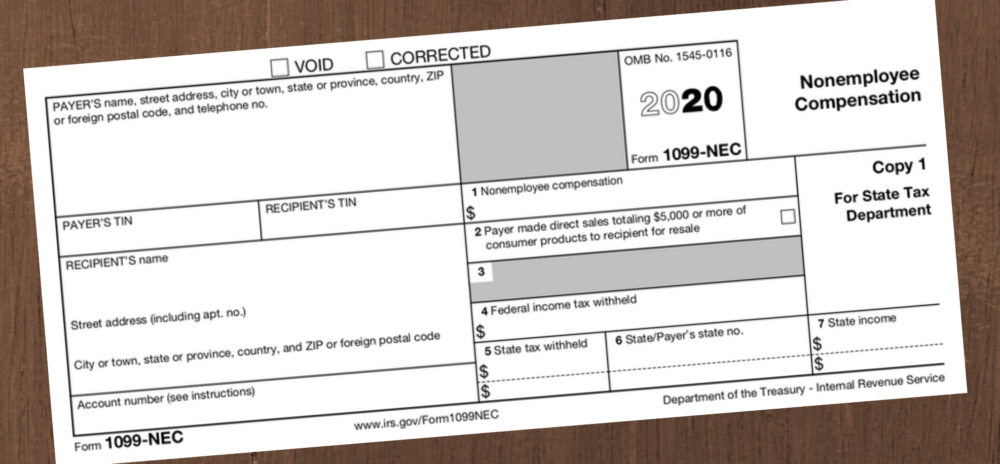

This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but.

. In your example you made 10000 on your 1099 and drove 10000 miles. Amazon will issue a 1099 to Flex Drivers. Does Amazon Flex take out federal and state taxes.

I made a pretty good amount from when I started last year. Tap Forgot password and follow the instructions to receive assistance. This is a 1099 position and Amazon will not take out or withhold taxes for you.

Amazon Flex drivers are self-employed. I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k. No You are an Independent Contractor.

As an Amazon Flex DoorDash Uber Eats Grubh. Youll have to pay taxes on your Amazon Flex earnings as you earn it throughout the year in the same way that you normally would. Youre suppose to pay quarterly which I.

Select Sign in with Amazon 3. Asked October 10 2017. Beyond just mileage or car.

Sign out of the Amazon Flex app. No matter what your goal is Amazon Flex helps you get there. This is your business income on which you owe taxes.

From there it is the. Driving for Amazon flex can be a good way to earn supplemental income. Amazon Flex quartly tax payments Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

In todays video I wanted to share with you guys how to file a tax return if you are self-employed. In this position you are. You wont be able to deduct your expenses.

Amazon Flex will not withhold income tax or file my taxes for me. Amazon Flex drivers are self-employed independent contractors in 2022. Answered December 24 2017.

Increase Your Earnings. Gig Economy Masters Course. Or download the Amazon Flex app.

Most drivers earn 18-25 an hour. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your. If you still cannot log into the Amazon Flex app.

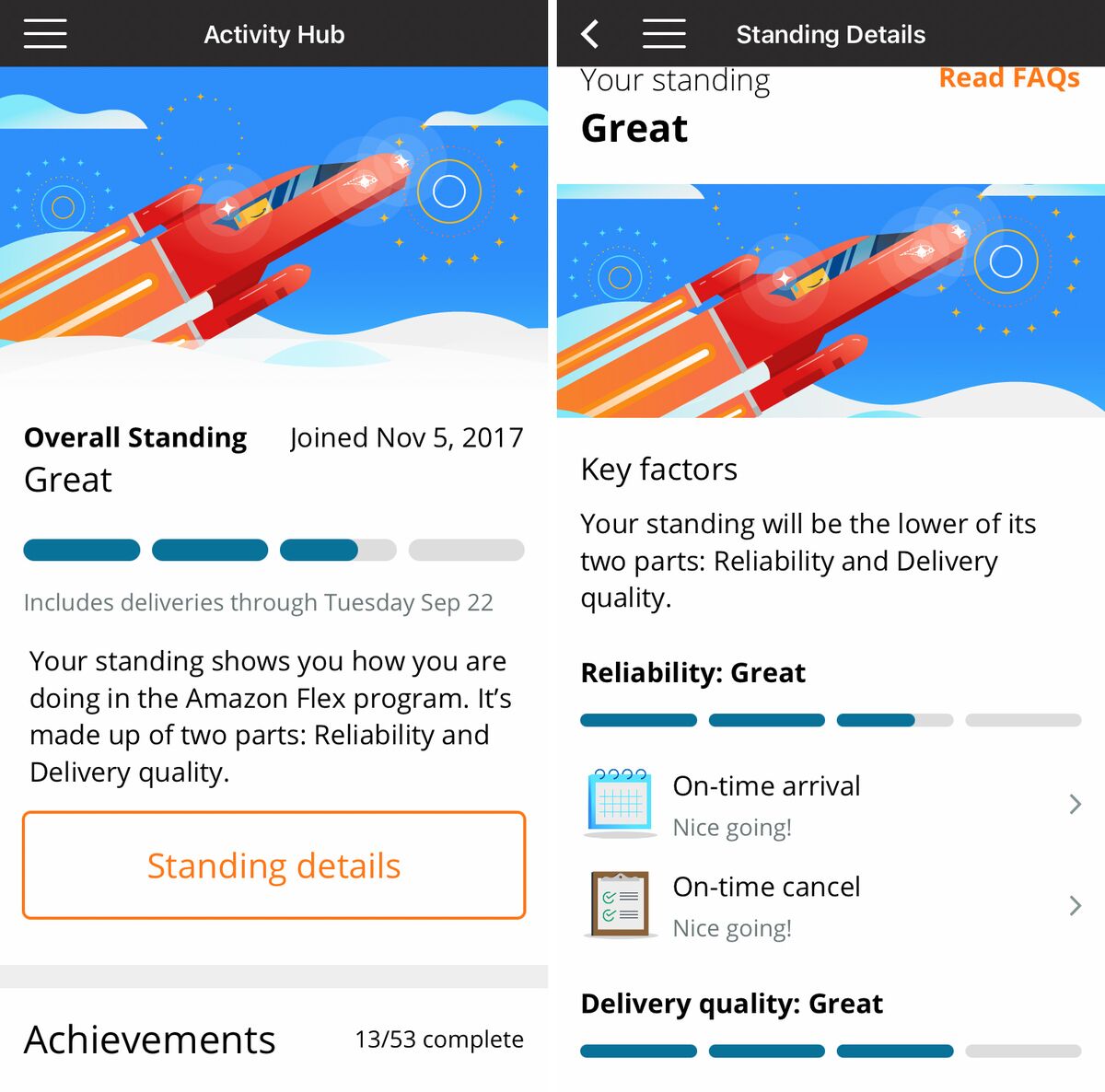

Amazon Rewards Program Makes It Easier For Drivers To Get More Work

Guide To Filing Tax Returns For Delivery Drivers In 2022

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Become An Amazon Flex Driver Complete Guide Gigworker Com

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Fired By Bot Amazon Turns To Machine Managers And Workers Are Losing Out Bloomberg

Drivers For Amazon Flex Can Wind Up Earning Less Than They Realize The Seattle Times

Everlance Mileage Tracker Apps On Google Play

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

How To Use The New 1099 Nec Form For 2020 Swk Technologies Inc

How Much Do Amazon Flex Drivers Make Gridwise

Amazon Flex Vs Doordash Best Job Guide 2022 Service Club

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide

Ducktrapmotel Consumer Questions Answered

Taking Flexible Schedules Into The Future Paychex